0 comment Wednesday, August 6, 2014 | admin

All I really want to do is post pictures of our butchered, moldering pumpkin and my fool-proof recipe for chuck roast. But I'm an obvious Betty Crocker impostor and my six faithful readers deserve better (Hi, Mom).

All I really want to do is post pictures of our butchered, moldering pumpkin and my fool-proof recipe for chuck roast. But I'm an obvious Betty Crocker impostor and my six faithful readers deserve better (Hi, Mom). Nor could I bring myself to blog about this today. There just weren't enough Tums in my medicine cabinet.

Nor could I bring myself to blog about this today. There just weren't enough Tums in my medicine cabinet.So, ho, ho. Ho, hum, it's back to the economy glum.

But perhaps there is a sliver of good news. A modern-day Brooksley Born has apparently emerged in the form of Rob Johnson, of the Roosevelt Institute. There's not much I can add to this piece in Harpers, highlighted over at the eco-blog Naked Capitalism.

It's about derivatives reform or, I should say, the lack thereof. Because, knock me over with a feather, the financial services industry -- Goldman Sachs included -- is lobbying hard to prevent these exotic instruments from being posted and traded on a transparent exchange. And Congress is readily, happily pandering to them.

It's about derivatives reform or, I should say, the lack thereof. Because, knock me over with a feather, the financial services industry -- Goldman Sachs included -- is lobbying hard to prevent these exotic instruments from being posted and traded on a transparent exchange. And Congress is readily, happily pandering to them.The kicker? These banks are using our taxpayer dollars to fund their lobbying efforts. Can you say PPIP or TARP? TALF or BARF? Here's a happy headline for you: "Banks Lobby to Screw Taxpayers Out of Billions."

Sometimes I feel like screaming, "The Red Coats are Coming! The Red Coats are Coming!" but some parent-teacher conference or school carnival always gets in the way. So I'm telling you on my midnight ride.

Sometimes I feel like screaming, "The Red Coats are Coming! The Red Coats are Coming!" but some parent-teacher conference or school carnival always gets in the way. So I'm telling you on my midnight ride.Recall it was derivative contracts that got Brooksley Born up in arms and ultimately thrown under the bus; it was derivatives that brought our economy to its knees.

Collateralized debt obligations and credit default swaps (called "derivatives" because they're derived from the underlying mortgage) were treated like insurance policies. Except they weren't insurance at all, they were Vegas bets. Because the issuer was never required to set aside any "reserves."

Collateralized debt obligations and credit default swaps (called "derivatives" because they're derived from the underlying mortgage) were treated like insurance policies. Except they weren't insurance at all, they were Vegas bets. Because the issuer was never required to set aside any "reserves." The House Oversight Committee held a hearing this month about whether these weapons of wealth destruction should be "regulated." (Warren Buffett called them "financial weapons of mass destruction" back in 2003).

The House Oversight Committee held a hearing this month about whether these weapons of wealth destruction should be "regulated." (Warren Buffett called them "financial weapons of mass destruction" back in 2003).The hearing proceeded with little fanfare from the press. Maybe because derivatives are sort of boring, not to mention complicated. Maybe it was because of the coinciding super-colliding Balloon Boy escapade.

But at least Harper's covered it. Here, some excerpts from the piece:

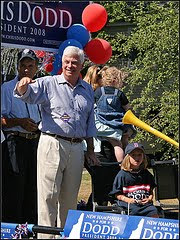

In response to complaints from Americans for Financial Reform, which represents hundreds of consumer groups and labor unions, the committee issued an invitation�the night before the hearing was held � to Rob Johnson of the Roosevelt Institute. For the committee, the last minute inclusion of Johnson � a former managing director at Bankers Trust Company and former economist at the Senate Banking Committee and Senate Budget Committee � apparently constituted sufficient balance.

Predictably, witnesses at the hearing trotted out positions urging caution in regard to the matter of reform. Derivatives and other exotic financial devices have reaped the finance industry vast profits, but for Hixson of Cargill the common man and woman would be the real losers if Congress were to act too severely. "We offer customized hedges to help bakeries manage price volatility of their flour so that their retail prices for baked goods can be as stable as possible for consumers and grocery stores," he told the committee�s wagging heads. "We offer customized hedges to help a restaurant chain maintain stable prices on their chicken so that the company can offer consistent prices and value for their retail customers when selling chicken sandwiches."

Johnson, who came last, offered the only serious critical viewpoint, saying that the American public had been "quite demoralized by�the bailouts that we experienced last fall." After about five minutes of his testimony, Congresswoman Melissa Bean�another industry-funded committee member who chaired the hearing because Frank was absent�had heard enough. "I�m just going to ask you to wrap up because we�re running out of time," she told Johnson.

Johnson gamely continued. "When I hear the testimony today that are largely financial institutions and end users, I believe that I represent a third group that comes to the table, which is the taxpayers, the working people of the United States," he said.

"I do need a final comment," Bean interjected seconds later.

That put an end to Johnson�s testimony. "I was just called to this hearing last night, so I will provide detailed comments on your bill and a statement for the record that will finish my comments," he concluded.

Not surprisingly, the House Oversight Committee seems to have "lost" Johnson's remarks. They are not included, with the testimony of the industry insiders who appeared and spoke, on the committee's website. But you can go here for a link to read Johnson's testimony and what he would have said, had the committee given him the time and chance.

Not surprisingly, the House Oversight Committee seems to have "lost" Johnson's remarks. They are not included, with the testimony of the industry insiders who appeared and spoke, on the committee's website. But you can go here for a link to read Johnson's testimony and what he would have said, had the committee given him the time and chance. This conduct is incredibly from the same elected body which actively tried to exclude members of Congress from the reach of a subpoena to Countrywide that casts a pretty wide net.

This conduct is incredibly from the same elected body which actively tried to exclude members of Congress from the reach of a subpoena to Countrywide that casts a pretty wide net.You see Congress is investigating Countrywide's subprime mortgage practices and the numerous VIPs -- the "friends of Mozilo" -- who received outrageously favorable and unconscionable loan terms.

Naturally, Congress didn't want Countrywide to turn over loan documents that would reveal the sweetheart mortgage deals Countrywide gave to them. The "friends of Anthony" or "friends of Mozilo" folks are friends in high places.

Naturally, Congress didn't want Countrywide to turn over loan documents that would reveal the sweetheart mortgage deals Countrywide gave to them. The "friends of Anthony" or "friends of Mozilo" folks are friends in high places.But hells bells. Can we really feign surprise when Congress tries protect their own?

I'm not feigning illness either, though I wish I were. Halloween is still two days away and already, having had not one piece of candy yet, on this news I'm about to throw up.

So jump in bed and cover your head. 'Cause the TARP tax man cometh tonight.

So jump in bed and cover your head. 'Cause the TARP tax man cometh tonight.Labels: Random