0 comment Tuesday, August 5, 2014 | admin

Goldman Sachs has been getting a lot of coverage lately. Just how did this giant rise up from the ashes of derivatives unscathed? How did JP Morgan and Morgan Stanley survive to thrive? A big part of the answer is credit default swap contracts.

Goldman Sachs has been getting a lot of coverage lately. Just how did this giant rise up from the ashes of derivatives unscathed? How did JP Morgan and Morgan Stanley survive to thrive? A big part of the answer is credit default swap contracts.So let's briefly revisit credit default swaps. I loan you money to buy a house. But you're a newly-minted masseuse with few clients and two kids. Plus, you're not putting any money down.

While I'm willing to bet on you (because I make a ton of money up front), I'm still worried you might bail. Or maybe I want to sell your loan to an unsuspecting pension fund in Iceland. If so, I'll need your loan to be triple-A rated.

While I'm willing to bet on you (because I make a ton of money up front), I'm still worried you might bail. Or maybe I want to sell your loan to an unsuspecting pension fund in Iceland. If so, I'll need your loan to be triple-A rated.How do I get your crappy loan highly rated so I can sell it? Or protect myself if I decide to hold it? Easy. I buy "insurance." It's called a "credit default swap," sold by outfits like AIG. If you don't pay, AIG has to cover it. With a CDS, now I can sell your loan or hold it. Whatever happens, I'm covered. I've hedged my bets.

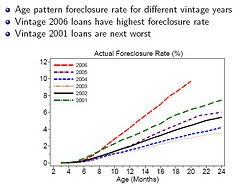

The trouble began when mortgage defaults started happening in massive numbers. That is to say, when housing prices, surprise, surprise not, stopped rising and began falling.

AIG, the major player who'd written all this "insurance" had to cover a bunch of bad mortgages, and cover them fast. But it couldn't because it simply didn't have the money. AIG gobbled up the "premiums" on these default swaps but never set aside any reserves.

AIG, the major player who'd written all this "insurance" had to cover a bunch of bad mortgages, and cover them fast. But it couldn't because it simply didn't have the money. AIG gobbled up the "premiums" on these default swaps but never set aside any reserves.This should have never occurred. But it's happened before and the government has always stepped in and bailed the banks out. So the banks were certain the government would be there for them this time, and they were right. Still, their behavior is no less disgraceful.

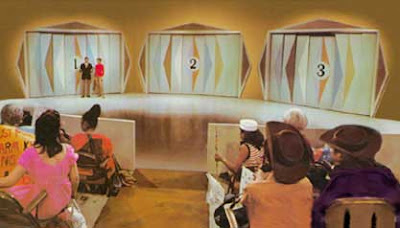

Imagine walking in to a Las Vegas casino and worrying whether, when you turned in your chips, the house had enough money to cash you out. Would you stay and bet or leave?

If you did stay and bet, as Goldman and JP Morgan, et al. did, would you expect the taxpayers to cash in your chips if the casino went broke? (Now you know what "moral hazard" means.)

If you did stay and bet, as Goldman and JP Morgan, et al. did, would you expect the taxpayers to cash in your chips if the casino went broke? (Now you know what "moral hazard" means.)That scenario is precisely what occurred in our financial markets; "casino" an apt metaphor (casino credit to Dylan Ratigan who coined it). Investment banks (the gamblers, or counterparties) made bets on subprime mortgages with AIG. AIG was the casino, the "house."

When it became clear that AIG couldn't cash in the chips, gamblers started running for the door. Worse still, the gamblers who'd bet in AIG's casino were also mini-casinos themselves. They, too, had written "insurance" policies, trading credit default swaps with their fellow players.

When it became clear that AIG couldn't cash in the chips, gamblers started running for the door. Worse still, the gamblers who'd bet in AIG's casino were also mini-casinos themselves. They, too, had written "insurance" policies, trading credit default swaps with their fellow players.Who held what? Who owed what to whom? How much was owed? No one knew. Counterparty panic set in and the government feared the entire financial system would collapse. Geithner, then president of the New York Federal Reserve, and Hank Paulson took over AIG's negotiations with its derivatives gamblers.

The two held a secret meeting and decided that you and I should pay off every gamble at 100 cents on the dollar in exchange for . . . nothing.

The two held a secret meeting and decided that you and I should pay off every gamble at 100 cents on the dollar in exchange for . . . nothing.The taxpayers, Geithner and Paulson decided, would stand in the shoes of AIG and become the insurers of these bad credit default swaps. Even though the gamblers knew, or surely should have known, they were making suspect bets in a wobbly casino.

What's more, Geithner's and Paulson's unseemly and exceedingly close ties to these big banks makes their decisions in the AIG and bank bailouts all the more appalling, shocking even.

What's more, Geithner's and Paulson's unseemly and exceedingly close ties to these big banks makes their decisions in the AIG and bank bailouts all the more appalling, shocking even.Today those banks are today posting record profits and paying themselves the highest bonuses ever.

But our children will be paying the price for the government's purchase (and guaranties) of these radioactive debts for decades to come, and not just in the form of higher taxes. There's a psychological component our children feel from this depression, too, and they'll ultimately have less access to higher education, lower wages, and fewer job opportunities.

Our children will pay because the politicians in D.C., headed up by Treasury Secretary Timothy Geithner, did things like pay AIG's gambler creditors 100% on the dollar with our money and issue blanket guarantees to the banks, while at the same time they screwed GM's creditors to the wall.

How, and under what authority, I'd like to know, did Congress and our Commander-in-Chief appoint themselves the country's top-dog bankruptcy judge?

Meanwhile our own country's bankruptcy looms. We still don't know how much we're on the hook for, because the Federal Reserve won't tell us. And since Ron Paul's "audit the Fed" bill was shot down, we probably never will. The TARP Inspector General says he's really not sure, but the absolute worst case? 23 TRILLION, give or take a few.

The bailout of AIG and the other banks was nothing more than a cash infusion from taxpayers into the casino. We covered billions on the bets of Goldman and JP Morgan and so on. And we gave them billions of dollars directly, in return for virtually nothing. They're still at the craps table, gambling our taxpayer dollars.

It's like we're casino waitresses, hoping to get by on tips while the high-rollers have been taken care of. For them, everything's been "comped" and they're making more money than ever. Hell, even their bets are comped with the taxes we're paying on our tips.

It's like we're casino waitresses, hoping to get by on tips while the high-rollers have been taken care of. For them, everything's been "comped" and they're making more money than ever. Hell, even their bets are comped with the taxes we're paying on our tips.When D.C. politicians allow the banks to make unfettered bets with our money and our children's futures, we need to start paying attention. Because more bailouts are on the way.

Wall Street made bad gambles and our government decided that you and I should pay for their mistakes. Now it's business as usual on Wall Street while the rest of America chokes on 10.2% unemployment, record foreclosures, and more pain to come. Thousands upon thousands of dollars in increased taxes we will be forced to shoulder.

The Democrats' "stimulus" spending and bank bailouts are an unmitigated disaster yet the bailout just keeps going and going. The banks' debt has been socialized but their profits remain privatized. It's outrageous. And the bad guys are still in charge.

And all of this before we even begin to factor in the costs for cash-for-clunkers, an $8,000.00 first-time home-buyer credit, universal health care and cap and trade. But the bought-off pols in Washington tell us not to worry, that we can handle it. It's a twisted version of "Yes, we can."

And all of this before we even begin to factor in the costs for cash-for-clunkers, an $8,000.00 first-time home-buyer credit, universal health care and cap and trade. But the bought-off pols in Washington tell us not to worry, that we can handle it. It's a twisted version of "Yes, we can." I say no, we can't.

I say no, we can't.When the Dems tagged Republicans "the party of 'No,'" they did them a favor. Frugal is sexy these days, and the party of "No" is looking better and better.

Labels: Random