0 comment Friday, May 23, 2014 | admin

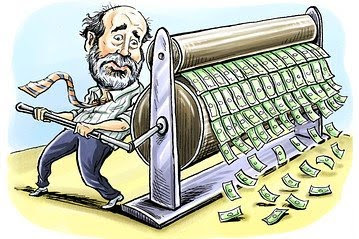

Interesting terms like "QE2" and "quantitative easing" are being bandied about these days, used to describe the Federal Reserve's latest move, which is to print another six hundred+ billion dollars and put those dollars into the hands of Wall Street banks and investors.

Interesting terms like "QE2" and "quantitative easing" are being bandied about these days, used to describe the Federal Reserve's latest move, which is to print another six hundred+ billion dollars and put those dollars into the hands of Wall Street banks and investors."Quantitative easing" is just a fancy euphemism for printing money. "QE2" denotes this is the second wave of money printing (remember the first one, for a trillion? and how well that worked?).

Why print money, you ask? If our country's biggest problem is debt (inevitably followed by higher taxes), why on earth are we incurring more, you may reasonably wonder.

And I don't have an answer for you. It's hard to believe the well-credentialed chairman of the Fed, Ben Bernanke, is doing something so incredibly stupid. But, well, he is.

Here's how his convoluted plan is supposed to work: He'll buy newly-issued Treasury notes from the Treasury and existing Treasury notes from the banks and investors, all with newly printed money. This will keep interest rates low.

Then the banks and investors will use their new found cash to lend to small businesses at crazy low interest rates. Oh, and they'll buy a bunch of stocks with some of their money, too.

Small businesses, flush with borrowed cash, will create new jobs and hire people. And higher stock prices will make consumers feel grrreat(!) about their 401ks again, spurring them to spend. Remember the "wealth effect"?

Small businesses, flush with borrowed cash, will create new jobs and hire people. And higher stock prices will make consumers feel grrreat(!) about their 401ks again, spurring them to spend. Remember the "wealth effect"?And then businesses will hire more people. Stocks will go even higher. Consumers will spend even more! It will be one big virtuous circle! Hooray!

What could go wrong?

First of all, hello? Small businesses don't want to borrow.

Consumers don't want to borrow or spend.

Consumers don't want to borrow or spend.And at least one smart analyst says the banks will just tuck a good chunk of this money into their reserve accounts because the Fed is paying them interest on their reserves (for the first time in history), and an attractive interest rate at that. (You read that right. The Fed tells banks "lend!" on the one hand and "we'll pay you to hold it" on the other).

In actuality, banks and investors will take their newly printed money and put it into emerging markets. The thing is, putting money in these foreign markets results in higher prices in those markets, due to increased demand.

In actuality, banks and investors will take their newly printed money and put it into emerging markets. The thing is, putting money in these foreign markets results in higher prices in those markets, due to increased demand. And guess what? These foreign governments don't want higher prices. They're already battling inflation as it is. Not to mention, higher prices in their exports -- think flat screen TVs, hell, lots of other stuff -- will reduce our own country's demand for these goods.

And guess what? These foreign governments don't want higher prices. They're already battling inflation as it is. Not to mention, higher prices in their exports -- think flat screen TVs, hell, lots of other stuff -- will reduce our own country's demand for these goods. So, surprise, surprise, these foreign governments are hopping mad at the Fed. And if they get super-duper mad, do you think they won't slap high tariffs on our exports to their countries? Can you say "trade wars"?

A virtuous circle? More like "vicious circle."

A virtuous circle? More like "vicious circle." All this $600+ billion in quantitative easing instant money will do is devalue our dollar and cause inflation here at home. Again, think flat screen TVs, except now they're prohibitively expensive. Worse, these new Treasury issues will drastically increase our nation's debt.

Why, oh why does anyone in Washington think the solution to our debt is to borrow and spend our way out of this recession? Borrowing and spending is what brought us here in the first place.

Why, oh why does anyone in Washington think the solution to our debt is to borrow and spend our way out of this recession? Borrowing and spending is what brought us here in the first place.We need only look to Japan to see how ludicrous is this notion. Give a listen to my econ-hero, Kyle Bass. He pretty much speaks in plain English. (Ignore the basis points stuff -- you'll still get the message. Besides, David Faber is total mind eye candy).