0 comment Saturday, August 23, 2014 | admin

Greetings. Lawyer Mom here.

Greetings. Lawyer Mom here.I've had so much trouble with blogger instantly publishing my posts when I'm smack dab in the middle of typing my smack that I've a habit of going to my "link" line and typing in ".dumb" instead of ".com" before I ever type my first word.

And in the past, embedding this error has saved me from premature publication on countless occasions.

But tonight, before I could even get there, the silly computer "published" my non-post. What was it? Nothing more than a link to my old "subprime soccer mom" post. Which is fine, I guess, except I intended to include a preamble of sorts.

So let me explain.

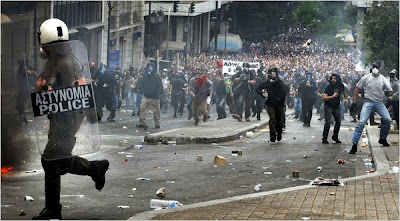

All day I've been watching the riots in Greece. What's going on over there? Nothing more than government employees and citizens on the dole protesting the new "austerity" measures (i.e., cuts to their wages and benefits) their government is about to impose.

Have you heard the term PIGS? It's an acronym that stands for Portugal, Ireland, Italy, Greece and Spain. Ah, PIGS. Endearing, eh?

Anyway, the PIGS are deeply mired in the mud of their respective pig styes. None of them are willing to cut spending in order to forestall their countries' impending bankruptcies, or reduce their countries' debts. Greece is the first domino to fall and so all eyes are on Greece . . . for the moment. The IMF (International Monetary Fund) has agreed to bail Greece out, but if and only if the citizens of Greece are willing to feel some pain.

Judging from the riots we've seen over there, the Greeks aren't ready for any austerity -- period. But before we start feeling all superior and high and mighty, consider this: should any of us in the United States care about Greece?

Umm, well, yes. It means a lot to us my friends, because we, sad to say, are the next Greece. We are the next PIG. We are spending so much more than we are taking in, and the numbers are staggering. If we continue spending at our current rate --and remember, for this fiscal year, Obama raised federal spending by nearly 12% -- and we actually stick to our "spending freeze," in ten years our debt will still be 90% of our GDP. If that feels unthinkable, it's because it is unthinkable. No one, and I mean NO ONE, will buy our debt. Would you be willing to finance us?

See why I'm saying we're the next Greece? But don't take my word for it. Look at the stock market, for starters.

Even more worrisome and depressing, is there anyone in Washington who gives a rat's a--? (Oh, and ObamaCare? Don't get me started. Read this if you need a cure for your narcolepsy -- otherwise, run, because you'll never get a good night's rest again).

Just like Greece, there's a battle soon coming in our country: the taxpayers versus government employees and entitlement recipients. Right now it's just percolating, but when it reaches full boil, today's riots in Greece will look like a Maypole festival.

Below I've cut and pasted my sorry-it's-so-long post about subprime mortgages and why this small sector of our financial system is affecting us all so greatly, and why defaulting U.S. mortgages continue to affect not only us, but the global economy.

Maybe it will help explain the sovereign debt crisis, and the words and phrases we hear in the media, like PIGS, "debt threats," and "sovereign defaults." High hopes, I know, but then it's all in keeping with my character: I'm a cockeyed optimist, don't you know? Have you ever heard me say the sky is falling? Ha. I think not.

That said, I'd also hoped to have some time to tweak this post before I hit the orange "publish post" button but my computer beat me to the punch.

And since it did publish the whole damn thing while I was in the bathroom, leaving me with no choice but to forge ahead, here's my effort at salvaging something and getting the conversation started.

XOXO

Lawyer Mom

___________________________________________________

I get the basic subprime thing: a bunch of really stupid banks gave house loans to a bunch of really stupid people and then all hell broke loose. What I didn't get is why they made those stupid loans, and why it's turned into an all-hells'-breaking-loose 700 billion dollar problem.

I get the basic subprime thing: a bunch of really stupid banks gave house loans to a bunch of really stupid people and then all hell broke loose. What I didn't get is why they made those stupid loans, and why it's turned into an all-hells'-breaking-loose 700 billion dollar problem.After pouring over articles for months on end, my goal was to distill the information, explain in a few short paragraphs why this crisis has burgeoned. But alas, I do not have the talent; the beast has too many moving parts. So be forewarned. I've tried to simplify things, but this post is still very long and very wonky.

How it all began. A lot of smart folks say it started with a glut of foreign investment money. High oil prices allowed other countries to grow in wealth. They saved their money and were looking to grow it. Conventional investments, like treasury notes, weren't paying terribly high returns.

How it all began. A lot of smart folks say it started with a glut of foreign investment money. High oil prices allowed other countries to grow in wealth. They saved their money and were looking to grow it. Conventional investments, like treasury notes, weren't paying terribly high returns.Wall Street wizards realized these hungry investors would snap up U.S. mortgages. So they came up with a plan to turn these mortgages into securities and sell them.

Demystifying tranching and collateralized debt obligations. Here's how it works. A bunch of people take out mortgages. The Wall Street guys bundle them up into one big clump and subdivide the big clump into groups of, oh say, good borrowers, mediocre borrowers, pretty bad, and really bad borrowers. This is called tranching.

Demystifying tranching and collateralized debt obligations. Here's how it works. A bunch of people take out mortgages. The Wall Street guys bundle them up into one big clump and subdivide the big clump into groups of, oh say, good borrowers, mediocre borrowers, pretty bad, and really bad borrowers. This is called tranching.Each tranch is assigned a number of shares, sort of like stock. Investors can buy shares in any given tranch. The "shares" are called collateralized debt obligations, or CDOs.

As the borrowers make mortgage payments every month, the interest paid is doled out to the CDO investors in different amounts, depending on which tranch they are in.

The investors in the "good borrowers" tranch (the "super senior" tranch) get their interest paid first and the middle or "mezzanine" tranch guys get paid next. The bottom (bad borrowers) tranch investors get paid last, but they get the highest interest rate since they're in the riskiest position.

Why lending standards got so lax that anyone could get a mortgage. Neighborhood banks who used to eyeball the borrower and make sure he was credit-worthy were replaced by mortgage brokers like Countrywide. Brokers just originated the loans, they didn't hold on to them and carry them on their books. The mortgages were passed on to the Wall Street CDO guys.

Why lending standards got so lax that anyone could get a mortgage. Neighborhood banks who used to eyeball the borrower and make sure he was credit-worthy were replaced by mortgage brokers like Countrywide. Brokers just originated the loans, they didn't hold on to them and carry them on their books. The mortgages were passed on to the Wall Street CDO guys.But there were not enough CDOs to go around. The returns were so good that investors wanted more. So the Wall Street boys called brokers like Countrywide and said, "Hey, down there. We need more mortgages so we can sell more CDOs. They're flying off the shelves." The brokers said, "We'd love to get you some more, but we're out of bodies. There's no one left who qualifies for a loan."

"Screw it," said the Wall Street wizards, "forget about down payments, verifying income, whatever. Just get us more mortgages so we can sell more CDOs." And so the Main Street guys did. NINJA loans (no income, no job, no assets) and interest-only loans were made. Who cared if the borrowers sucked? It was someone else's problem. It was other people's money.

"Screw it," said the Wall Street wizards, "forget about down payments, verifying income, whatever. Just get us more mortgages so we can sell more CDOs." And so the Main Street guys did. NINJA loans (no income, no job, no assets) and interest-only loans were made. Who cared if the borrowers sucked? It was someone else's problem. It was other people's money.Why weren't investors worried the borrowers would default? It's true that even migrant workers were getting loans for million dollar houses. And no doubt, many of these CDOs could not be classified as good assets. But these CDOs were paying great returns and the default rate was low.

Default rates were low because house prices were continuing to climb. Never mind that prices were climbing at a rate never before seen in our country's history, and were unsustainable. As long as houses kept going up in value, the default rate was not a problem. If a borrower got into trouble, he could just sell his house for what he paid for it, or maybe more.

For quite a while, CDOs were veritable cash cows. Investors were gobbling them up. Pension funds and other investors limited to "safe" investments wanted in on the action, too. Enter the saviour: the credit default swap (CDS) contract.

For quite a while, CDOs were veritable cash cows. Investors were gobbling them up. Pension funds and other investors limited to "safe" investments wanted in on the action, too. Enter the saviour: the credit default swap (CDS) contract.A CDS basically worked like this: A company like Bear or AIG would say, "don't worry, CDO investor. We are a strong and reputable company, rated Triple A by Moody's. If some borrowers default and you don't get all of your interest payment, we'll pay the difference. You'll never suffer a loss." In return, the CDO holder paid AIG (or Bear or whoever) an "insurance premium."

With a CDS insurance policy in place, ratings companies like Moody's could rate the top tranch, or "super senior" CDOs as triple A, or whatever rating was needed to put them in the "safe" category.

Wow! Who could resist an investment like this? It paid great returns, and it was backed by collateral that was going up in value plus an "insurance" policy. So CDOs were "no brainers," right?

Wow! Who could resist an investment like this? It paid great returns, and it was backed by collateral that was going up in value plus an "insurance" policy. So CDOs were "no brainers," right?Inherent problem # 1: the CDS contracts were naked bets: The guys who wrote these "insurance" policies were so confident the mortgages wouldn't default that they didn't put enough (maybe any?) money aside to pay out loss claims if the mortgages went south.

When you buy fire insurance on your house, the insurance company is required by law to set a certain amount of your premium aside in reserves. So if you have a fire, the insurance company has the money to pay your claim. Same deal with auto insurance, homeowners insurance, all that stuff.

But for CDS contracts, there was no law requiring these "insurers" to set aside any of the premiums paid by the CDO holders. AIG could write CDS contracts for billions and billions of dollars, even if AIG did not have billions in its bank account to pay potential claims. These credit default swaps weren't "insurance" policies at all. They were naked bets.

But for CDS contracts, there was no law requiring these "insurers" to set aside any of the premiums paid by the CDO holders. AIG could write CDS contracts for billions and billions of dollars, even if AIG did not have billions in its bank account to pay potential claims. These credit default swaps weren't "insurance" policies at all. They were naked bets.To make matters worse, there was no regulation of how many CDS contracts a company could write. As long as Moody's or Standard & Poor kept the "insuring" companies' ratings at an acceptable level, these guys could write all the CDS contracts they wanted to.

Inherent problem #2: the rating system for CDOs was whacked. Remember, pension funds and little towns in Iceland only wanted to buy CDOs rated as "safe" and they relied on rating companies to accurately classify these CDO investments.

Inherent problem #2: the rating system for CDOs was whacked. Remember, pension funds and little towns in Iceland only wanted to buy CDOs rated as "safe" and they relied on rating companies to accurately classify these CDO investments.But the rating companies have an inherent conflict of interest. They only get paid if the Wall Street guys asking for the rating like what they say.

Suppose, for example, Bear has a big clump of mortgages it wants to securitize. It goes to Moody's and says, "Hey. We want you to rate our top tranch, our senior tranch, triple A." But the top tranch has some crappy loans in it.

If Moody's balks and says, "umm, well, no, we don't think those borrowers are so hot," Bear can just pick up its marbles and walk down the street to another rating company, like Standard & Poor. In other words, Moody's only gets Bear's business if Bear likes Moody's rating.

If Moody's balks and says, "umm, well, no, we don't think those borrowers are so hot," Bear can just pick up its marbles and walk down the street to another rating company, like Standard & Poor. In other words, Moody's only gets Bear's business if Bear likes Moody's rating. Why did house prices go so high, so fast? Housing prices went completely out of control at an alarming pace. And everybody in the chain played a part, from the Wall Street and Countrywide guys to the companies like Moody's and Standard & Poor -- who rated so many of these sub-shit loans as "safe."

Why did house prices go so high, so fast? Housing prices went completely out of control at an alarming pace. And everybody in the chain played a part, from the Wall Street and Countrywide guys to the companies like Moody's and Standard & Poor -- who rated so many of these sub-shit loans as "safe." It was a vicious spiral. When these guys created an enormous pool of "qualified" borrowers, they also created an enormous demand for houses. When a bunch of people want houses, housing prices go up, defaults stay low, more investors pour money into CDOs, more loans are made, and so on and so on.

It was a vicious spiral. When these guys created an enormous pool of "qualified" borrowers, they also created an enormous demand for houses. When a bunch of people want houses, housing prices go up, defaults stay low, more investors pour money into CDOs, more loans are made, and so on and so on. Why did housing prices stop going up and start going down so fast? Without delving into this too far, quite a few smart folks believe the subprime defaults were initially triggered when the Fed (think Greenspan, then Bernanke) started raising interest rates in the last few years. The Fed Funds rate went from 1% in 2004 to over 5% by January of 2007.

Why did housing prices stop going up and start going down so fast? Without delving into this too far, quite a few smart folks believe the subprime defaults were initially triggered when the Fed (think Greenspan, then Bernanke) started raising interest rates in the last few years. The Fed Funds rate went from 1% in 2004 to over 5% by January of 2007.Adjustable rate mortgages started re-setting at high interest rates and the already teetering borrowers could not make the higher payments. Boom. A rash of foreclosures in a neighborhood brings down all the houses in the neighborhood.

Why did the subprime defaults affect so many other parts of the economy? Why is it such a big deal? When the subprime mortgages started defaulting, a blood bath was born. The guys who wrote the credit default swap contracts couldn't pay the losses from the defaults. CDOs plunged in value. This caused a cascading effect.

Investment banks sold CDOs but they owned CDOs too. And they wrote credit swap default contracts for each other. When Bear had hedge fund meltdowns and was forced to write down billions in CDO losses, people were afraid Bear couldn't make good on its credit default swap contracts. So they panicked and made a run on Bear, pulling their money out as fast as they could.

Investment banks sold CDOs but they owned CDOs too. And they wrote credit swap default contracts for each other. When Bear had hedge fund meltdowns and was forced to write down billions in CDO losses, people were afraid Bear couldn't make good on its credit default swap contracts. So they panicked and made a run on Bear, pulling their money out as fast as they could.Indeed, when Bear went down, the solvency of other investment banks was immediately questioned. No one knew if their counterparties (the guys who wrote the CDS contracts and were supposed to cover their losses) were any good.

Suppose Lehmans had been looking to Bear to pay up if its CDOs went bad. If Bear is not a good counterparty, Lehmans would be left holding the bag with no insurance to cover its losses. This, in turn, leaves Lehmans broke and it can't make good on the CDS contracts it wrote for other banks. Now those banks are in trouble too.

Suppose Lehmans had been looking to Bear to pay up if its CDOs went bad. If Bear is not a good counterparty, Lehmans would be left holding the bag with no insurance to cover its losses. This, in turn, leaves Lehmans broke and it can't make good on the CDS contracts it wrote for other banks. Now those banks are in trouble too.Who owed who what? And who was good for it? No one knew. And still no one knows. Banks are curled up in the fetal position.

The market for CDOs disappeared, turning "liquid" investments into worthless bricks. As Former Secretary of the Treasury Paul O�Neill so aptly put it, "It�s like you have 8 bottles of water and just one of them has arsenic in it. It becomes impossible to sell any of the other bottles because no one knows which one contains the poison."

The market for CDOs disappeared, turning "liquid" investments into worthless bricks. As Former Secretary of the Treasury Paul O�Neill so aptly put it, "It�s like you have 8 bottles of water and just one of them has arsenic in it. It becomes impossible to sell any of the other bottles because no one knows which one contains the poison." What's going on with the "bailout" plan? It seems to keep changing. Consider our government's initial approach. 700 billion dollars, handed over with no strings attached, tells us how bad things are.

What's going on with the "bailout" plan? It seems to keep changing. Consider our government's initial approach. 700 billion dollars, handed over with no strings attached, tells us how bad things are.At first blush, it looks like Treasury Secretary Paulson keeps vacillating about about how to spend the money. First he said the government would buy these shitty CDOs from the Wall Street banks, but then he insisted certain banks take billions in cash instead.

Personally, I don't think Paulson ever intended to take the "we'll buy the bad mortgages" path; more likely it was a ruse used to calm everyone down. If I were a betting girl, I'd bet his conversation with Bush went something like this:

Personally, I don't think Paulson ever intended to take the "we'll buy the bad mortgages" path; more likely it was a ruse used to calm everyone down. If I were a betting girl, I'd bet his conversation with Bush went something like this:Paulson: Mr. President, there's about to be a run on all the banks. We're talking a Mad Max scenario. Bush: Holy shit, Hank. What should we do? Paulson: give me a number, a REALLY big number. Some ginormous amount of money with no stipulations on it. The markets, the world must be confident we'll spend it however and wherever we need to, so we can stop the banks from falling like dominos. Bush: What's a big number, Hank? I didn't take geometry.Paulson: Ummm. 700 billion? That sounds pretty frigging big.Bush: Okay. And you'll use that money to buy the crappy CDOs, right?Paulson: Er, well, Mr. President, that's what we'll say we're doing. But what we'll actually do is throw money at banks. We can't buy the bad CDOs because then we'd have to value them. Once we did that, all the banks would have to revalue their own CDOs and restate their balance sheets. The revised balance sheets would show the banks are umm, insolvent. And then the runs would start. We're talking financial Armaggeddon. Better these CDOs go unvalued for as long as possible.Bush: Oh, right, Hank. I see what you mean. We can't have all of our banks in the red and trigger a run.And so it went, most likely.

Is the crisis limited to housing? No. People were using their houses like piggy banks, pulling equity out to pay their credit cards. There's no more equity. In fact a lot of people are upside down, owing more than their houses are worth. Consumers have hit a credit wall and can buy no more. Credit card defaults are on the rise, even as credit card companies raise interest rates and reduce credit limits. Retail businesses are getting slaughtered in the process.

Is the crisis limited to housing? No. People were using their houses like piggy banks, pulling equity out to pay their credit cards. There's no more equity. In fact a lot of people are upside down, owing more than their houses are worth. Consumers have hit a credit wall and can buy no more. Credit card defaults are on the rise, even as credit card companies raise interest rates and reduce credit limits. Retail businesses are getting slaughtered in the process.Another shoe likely to drop? CDOs backed by commercial mortgages. Scores of commercial borrowers, the guys who build hotels, shopping malls, office buildings and the like, got the same exotic mortgages the subprime folks did: interest-only, ARM, or teaser-rate loans.

With unemployment soaring and consumer spending screeching to a halt, retail stores are closing, killing malls and other retail developments. As a result, many commercial borrowers are expected to default. This could bring on another wave of bad CDOs and another calamitous cascade.

With unemployment soaring and consumer spending screeching to a halt, retail stores are closing, killing malls and other retail developments. As a result, many commercial borrowers are expected to default. This could bring on another wave of bad CDOs and another calamitous cascade. How bad could it get? Who knows? State and city services, things like maintaining roads and highways, schools, salaries for teachers, firefighters, garbage men, police officers are all dependent on property taxes. If residential and commercial property values take a nose dive, what then?

How bad could it get? Who knows? State and city services, things like maintaining roads and highways, schools, salaries for teachers, firefighters, garbage men, police officers are all dependent on property taxes. If residential and commercial property values take a nose dive, what then? I'm not optimistic. It looks like we've just touched the tip of the iceberg. At my house, we're watching reruns of the Waltons, learning how to live "depression" style. Who needs cable when you've got charades and jig-saw puzzles. Hell, who needs TV at all when there's CBS Radio Mystery Theater?

I'm not optimistic. It looks like we've just touched the tip of the iceberg. At my house, we're watching reruns of the Waltons, learning how to live "depression" style. Who needs cable when you've got charades and jig-saw puzzles. Hell, who needs TV at all when there's CBS Radio Mystery Theater?And I'm eating lots of crow, saying a lot of mea culpas. My husband was such an old fogey, I used to think, such a miser. Always on me to turn out the lights, turn up the air, turn down the heat, buy on the cheap. Lucky for me, he withstood my don't-worry-be-happy, let's-spend tendencies, and steadfastly refused to take out a big mortgage.

Miserly is the new smart, frugality has sex appeal. My husband, a handsome Albert Einstein, is romantic, too. After he saw last month's electric bill, he left me a voicemail, congratulating me on our low kilowatt usage. It was sweet.

Miserly is the new smart, frugality has sex appeal. My husband, a handsome Albert Einstein, is romantic, too. After he saw last month's electric bill, he left me a voicemail, congratulating me on our low kilowatt usage. It was sweet.Labels: Pigs, Sovereign Debt Default, Subcrime Crisis